PAPSS: Promising Results for the Pan-African Payment System

The 16 African countries that have so far signed up, have praised the elimination of the US

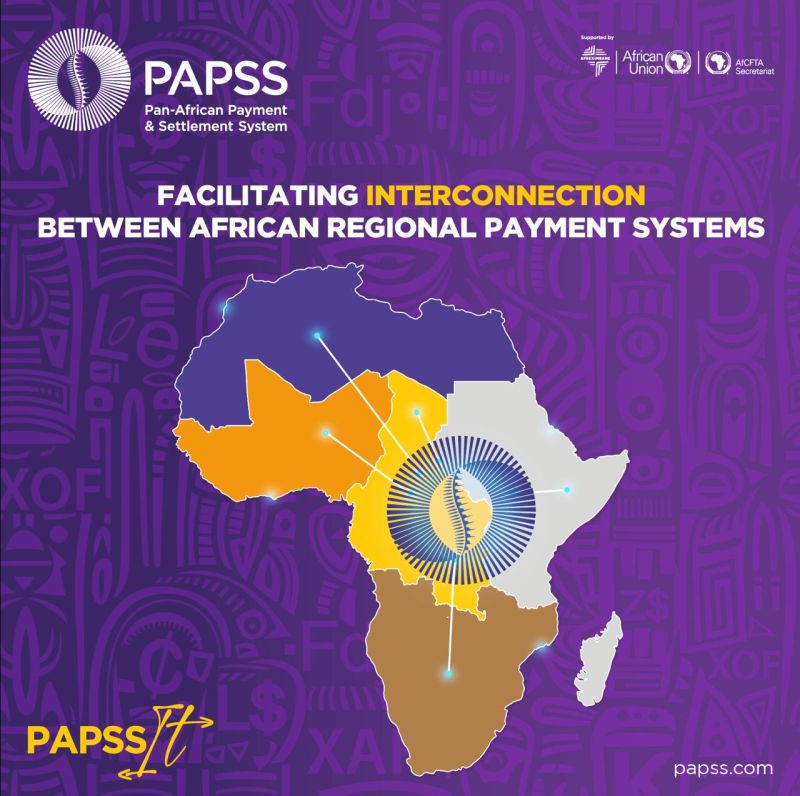

The Pan-African Payments Settlement System (Papss), which uses blockchain to eliminate the burden of currency incompatibility, has reduced cross-border payment delays.

The 16 African countries that have so far signed up, have praised the elimination of the US dollar as a third currency.

Launched by Afreximbank in collaboration with the African Union in 2019, the system has reduced the time it takes to make cross-border payments and transactions from days to just minutes.

Read: Explainer: Africa’s new online foreign exchange systemAccording to Mike Ogbalu, Papss CEO, the system was developed in response to the challenges faced by corporations and conglomerates operating across multiple African countries, arising from currency incompatibilities and reliance on hard currencies.“This challenged us into coming up with the Papss African currency marketplace, which has been rolled out in partnership with Interstellar, a blockchain company,” Mr Ogbalu said on the sidelines of the Afreximbank annual meeting in Abuja, Nigeria, last week.

The system facilitates the direct exchange of African currencies, eliminating the need for third-party currencies such as the euro or US dollar. The hegemony of the greenback over African currencies has been a necessary evil — one that attracted extra costs and holds trade to ransom during shortages.

The payment system operates in real time, with transactions completed in minutes, relying on an integrated network of 16 central banks, 150 banks and 14 switches.“This is not just a technical innovation, but a fundamental shift,” Mr Ogbalu said.

Dr Yemi Kale, Afreximbank’s chief economist, said that the elimination of the dollar in favour of transacting in local currencies across borders is still slow but with the payment system having real market use cases, gradually, will lead to its widespread adoption.“It’s been moving a bit slowly, when you’ve had a system in place for decades and you are changing it, it takes some time. It’s a gradual process, you can’t do it overnight,” she said.“People have to change their laws, their rules and adjust to what they’ve been used to for many years. Some have to change their trading partners — 85 percent of intra-African trade is with the same trading partners. So, how do you suddenly stop using dollars? It’s a gradual process, but we’ve seen significant progress in the past three years.”She said the move away from the dollar-dominated global financial system is helping.

“Even China and others want to get out of the dollar dominance: As you trade with Asia, Europe, US and others, it helps. This shift is happening at a time when it is very good for us.”Dr Kale said they are not worried about the threat of US pushback.“Africa is not the US problem – they see us as inconsequential: There is only two or three percent US trade with Africa, they are not really paying attention to what we are doing in terms of using our own currencies and bypassing the dollar, this will give us time to continue improving.”Airlines have been among the first entities to show interest in the solution, as they need to address the currency blocks that they suffer at the hands of African governments, who prevent them from repatriating their money, usually in dollars, which they need to finance their operations.

Over $2 billion belonging to airlines is held in African countries, where they operate. Insurers, telecoms and other companies are also facing similar problems over repatriation of money.

Nigerian lenders Zenith, UBA, First Bank, Access Bank and pan-African Ecobank have signed up, as have Kenya’s KCB and Bank of Kigali.

Countries that have integrated into the system include Nigeria, Ghana, Liberia, The Gambia, Guinea, Sierra Leone, Kenya, Zimbabwe, Zambia and Djibouti.